Analyst Model

Precision Signals, Better Profits

Combine predictive analyst metrics, surprise predictions, and revisions to receive a powerful, data-driven stock selection signal.

This model leverages unique TrueBeats earnings surprise forecasts, ensuring you receive more accurate predictions across EPS, sales, cash flow, and industry-specific KPIs.

- High Accuracy: TrueBeats predictions beat consensus forecasts by 60-75%

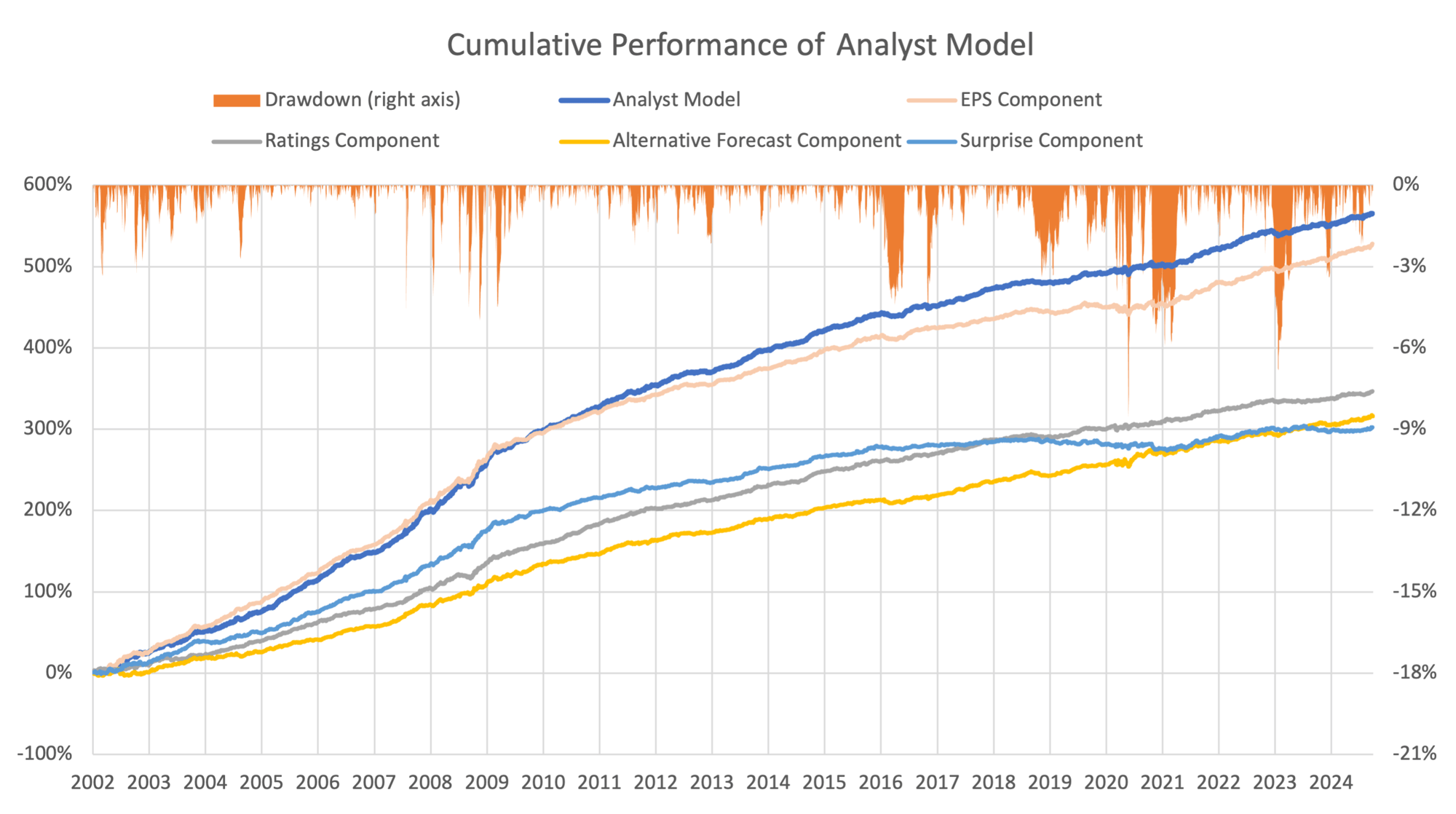

- Proven Returns: Top-decile stocks outperform bottom-decile by 24.9% annually (Sharpe ratio of 4.17)

- Minimal Drawdown: A modest maximum drawdown of -8.6%

- Efficient Turnover: Daily turnover of 7.9% aligns with ideal holding periods for maximum efficiency

How It Works

Model customers receive both the overall signal and underlying components and features, which include:

- TrueBeats Technology: We identify the most accurate and timely sell side analysts to create highly accurate TrueBeats surprise predictions.

- Analyst Revisions: We use analyst revisions across multiple estimate, KPI, and ratings items to create a comprehensive revisions signal.

- Post-Earnings Drift: We capture the value of post-earnings surprise drift.

Performance You Can Rely On

Over 2002-2024, this model has consistently delivered alpha, proving its effectiveness and surviving drawdowns with minimal risk.

Maximize returns with a new analyst sentiment signal powered by alternative data.

Get Actionable Insights

ExtractAlpha clients receive alternative datasets & trading signals with proven, predictive value for the KPIs you care about.

- Unique, accurate, and reliable data. Source data is cleaned, validated and ready to use

- Expertise in NLP and AI applied to dataset development

- Deep customer success guidance and advice

- Winner: Best Alternative Data Provider 2022 - 2025